As a professional trader I would certainly rather be looking for opportunities to short the ES or NQ. This predilection to short comes from more of a floor trader mentality, especially when markets are trading at high levels.

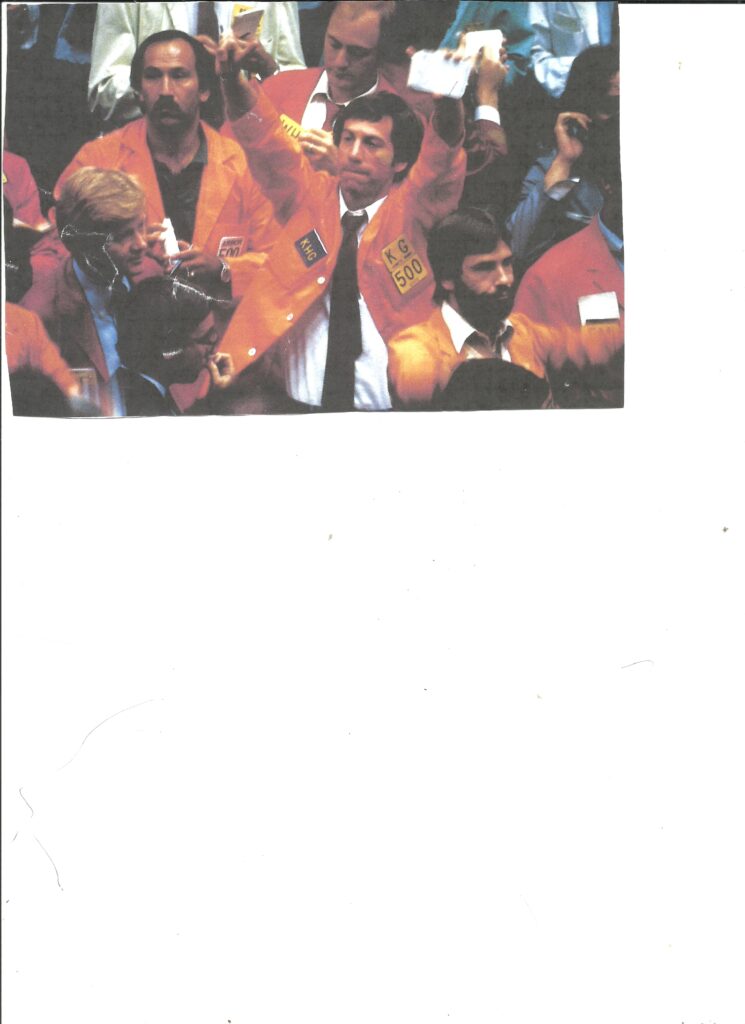

When floor trading dominated markets years ago, floor traders were at the transaction point of price discovery. The “edge” then was buying the bid or selling the offer, and jumping on board when prices appeared to be moving decidedly in one direction. Unfortunately the turn of direction often turned out to be the wrong direction.

The race for the “edge” over the last 25 years in developing electronic trading platforms has been expensive and competitive. While the arms race in HFT has slowed and thinned out as far as firm participation, new and existing markets are met with advanced platforms.

So as a trader with an opinion I would rather be short than long. An attitude can be expensive and a systematic trader should be trying to remove from the system the human tendency where a individual would rather avoid a loss than seek a gain. Avoiding a loss in my case here would be my attitude towards the long side.

Top center is myself. WH Soybean pit CBOT