Author: will

-

Market’s Risk vs Over Under

Passive indexers will say the market is efficient and few can beat it. How we look at data and especially how we determine risk is the key to successful strategies. Despite many bright folks who view the world in a macro perspective, they often under perform the market in big ways because their process depends…

-

Crying

Lots of carping about algos as it gets tougher for a large number of participants to beat markets. Without going into the efforts designed to magistrate the upside of equity prices by sovereigns and Fed, the main problem with non performers is their approach. Works for a bit and then dies. Adaptive quantitative approaches out…

-

The Fed and Bad Paper

Major indexes have the October jobs report behind them and the market bulls will now focus on marking up prices until the year end. Little has been able to side track the recovery from the Oct 16th lows where suddenly a curious black hole appeared and sucked up all the volatility of any price movement.…

-

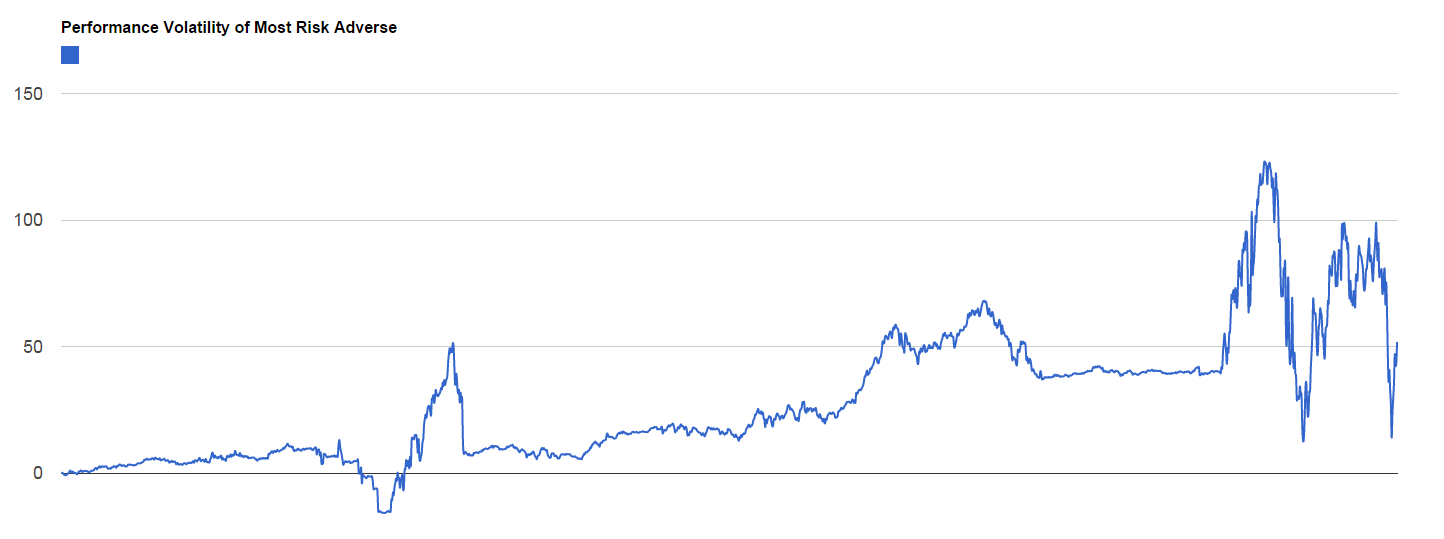

Risk Adverse Volatility

This is a performance chart of a risk adverse stock model. When volatility spikes on a stock with the lowest expectation in terms of risk, markets have increased downside potential. This chart is 2008 through October 28,2014. The spikes in volatility are all in 2014.

-

If Up

Volatility is back to normal as long as we remain in the bid mode. Managers continue to pile in with the fear of being too clever by reducing their holdings earlier in the year. This in itself does not guarantee a continued rally. With the Fed tomorrow, whiplash will reappear for a bit and then…

-

Hey You! You In or Out?

Market had a tantrum last week and then put a con on the Fed so they would squeeze the stimulus doll into saying ma ma. It is always a circle jerk in defense of equity prices since they are viewed as the world benchmark for economic stabilization. Spontaneous bear implosions are all over everyone’s shoes…

-

Third Quarter Low Now In or This Rally Is A Set Up?

Downside crying was so loud the Bears forgot to cover. Extreme short squeeze looks familiar as the markets reclaim old battle ground. Steep premium over value has now has appeared but not as wide as the discounts we saw culminate when posting one week ago today. Volatility disappeared and will stay gone if market continues…

-

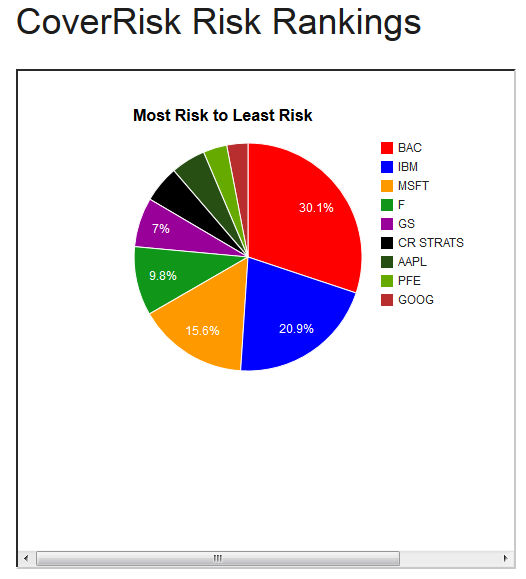

IBM Fall Not Surprising

IBM lists among the worst risk opportunities on the CoverRisk Q8.

-

What is Risk?

Understanding markets is tough. Creating adaptive strategies generating excess returns year after year is even tougher. CoverRisk does it. But because most managers, most investors, are so bad at understanding risk and how to play it, there has been an industry created in constant vigil to protect the market’s upside. This reaction to every downside…

-

Five Down Three To Go

AAPL BAC GOOG GS IBM MSFT F PFE Last 96.26 16.08 524.51 172.58 179.84 42.74 13.98 27.70 Change -1.28 0.32 -5.52 -4.66 -1.91 -0.48 0.36 -0.49 YTD 16.11 0.51 -35.85 -4.68 -7.73 5.33 -1.45 -2.93 %YTD 20.11% 3.28% -6.40% -2.64% -4.12% 14.25% -9.40% -9.57%