Month: December 2012

-

Its All Good

As the year wraps up for 2012, markets continue to benefit from the Fed’s ever corralling of investors to seek returns exceeding treasuries. Wall Street claims the US is only in need of a resolution to the fiscal cliff problem to resume an even greater growth trajectory. Proof they say comes primarily from the recovering…

-

Odds Increase of an Over the Cliff Event

In this game of Over the Cliff, the odds of going over the fiscal cliff now are 50/50, up from about a 33% chance earlier. As a player, assume there are three potential choices; (1) Over the Cliff (2) Good Compromise (3) Bad Compromise (Boehner Plan B) Given these three choices, in a game of…

-

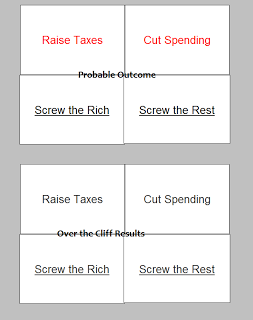

Political Tradeoff Matrix

The political deal tradeoff matrix gives you two most likely scenarios of action by the Washington participants. Choices (in red) on any two leaves the probable required tradeoff (in black) for the particular strategy. There seems to be no real difference between choosing to do the top matrix action and doing nothing in the bottom…

-

Market Participants Begin Move to Sidelines

Next week, with the fiscal cliff approaching, many market players will begin to reduce daily exposure to trading in futures and equities leaving the bulk of price action to professional traders to play thinning volume and the resulting increased volatility. Decision strategies for Democrats and Republicans have begun to emerge with both sides claiming they…

-

Preparing For Cliff

Fed shifted the qualitative and quantitative asset rules a bit today when they decided to use an economic outcome as a benchmark for continued accommodation; 6.5% unemployment rate. In a news conference later, Bernanke seem to be preparing for what the Fed sees as a long drawn out battle for economic recovery, one that is…

-

The Bad News If There Is Good News

Regardless of the outcome of the fiscal cliff, lets look at where the equity markets are in terms of value. Conventional wisdom apparently reasons any decent resolution to the fiscal cliff problem will send equity markets higher and interest rate markets lower (higher rates). Various reasons are applied most notably is the uncertainty element shall…

-

QRiskValue Over/Under

Monthly QRiskValue Over/Under AAPL Over BAC Over GOOG Over GS Under IBM Under MSFT Over F Over PFE Over

-

Cliff or Not to Cliff

It is much easier to win an election than it is to redistribute wealth. Since any deal before the Fiscal Cliff deadline is unlikely to be truly effective over much more than short term period, it is clear there is limited leverage in the deadline. Though we are dealing with economic issues facing the country,…